Business Insurance in and around Fort Worth

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

As a small business owner, you understand that sometimes the unanticipated does occur. Unfortunately, sometimes mishaps like an employee getting injured can happen on your business's property.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Get Down To Business With State Farm

Protecting your business from these possible mishaps is as easy as choosing State Farm. With this small business insurance, agent Mike McAda can not only help you construct a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

Don’t let worries about your business stress you out! Call or email State Farm agent Mike McAda today, and learn more about how you can meet your needs with State Farm small business insurance.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

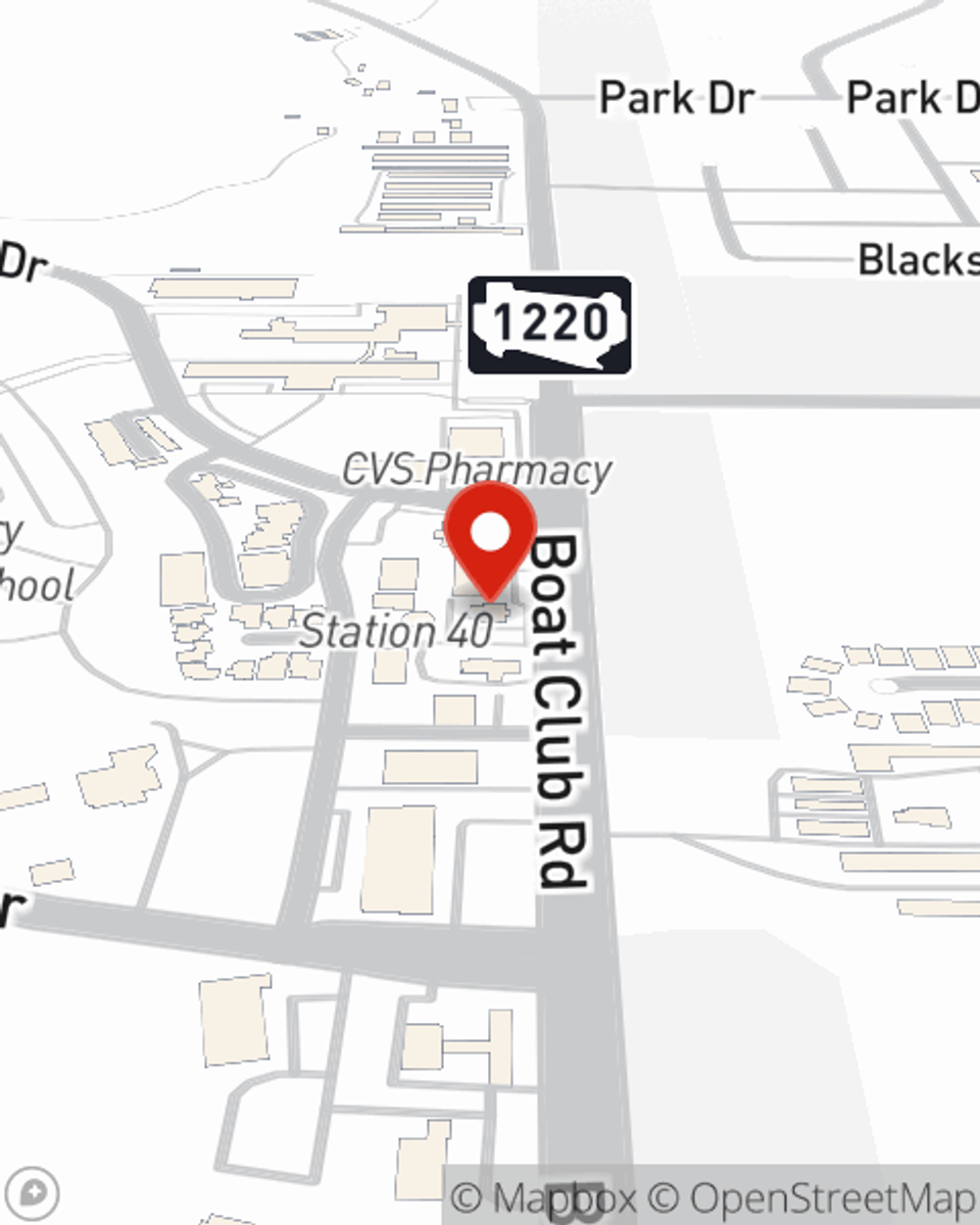

Mike McAda

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.